Health Insurance

Secure Your Health, Secure Your Future

Services

What we offer

Affordable, personalized health coverage to protect you and your family.

At KSimmons Insurance, we understand how vital it is to have access to quality healthcare. Whether you’re self-employed, between jobs, or seeking better coverage for your family, our health insurance services are designed to match your unique needs. We help you navigate the complex world of insurance so you can focus on what matters most: your health and your family.

Our licensed experts offer personalized consultations to help you find a plan that fits both your budget and your lifestyle. From routine checkups to major medical needs, we ensure you’re covered without unnecessary stress.

Why Choose KSimmons Insurance

- 30-Day Money Back Guarantee: We stand by our services. If you’re not satisfied within the first 30 days, we’ll refund your money—no questions asked.

- 95% Referral Rate: Our clients trust us enough to refer their friends and family, reflecting our commitment to exceptional service and client satisfaction.

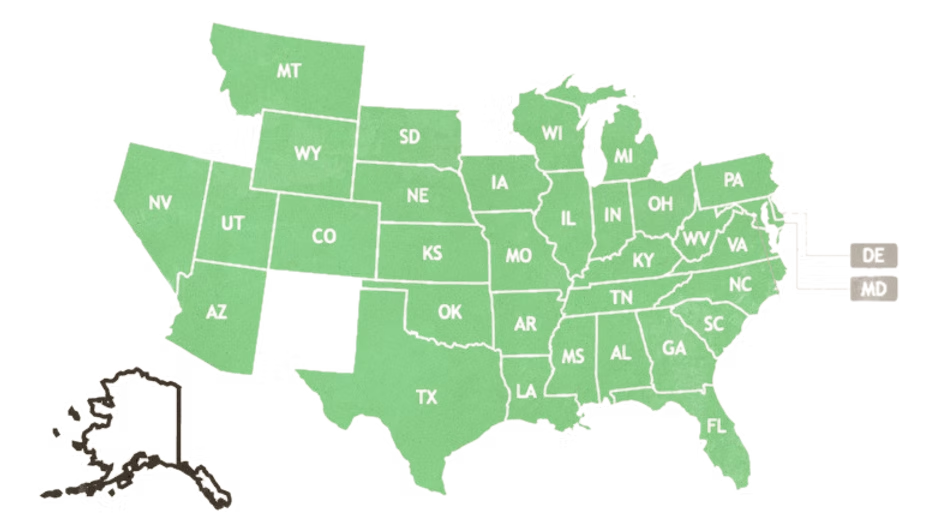

- Licensed in 32 States: Our broad licensing ensures that we can assist clients across a wide geographic area with consistent, reliable service.

Who We Help

- Families looking for affordable full-coverage plans

- Self-employed professionals needing independent coverage

- Retirees preparing for supplemental insurance

- Young adults seeking entry-level plans

What Makes Our Health Plans Stand Out

- Customized Plans: We tailor coverage options based on your medical needs and financial situation.

- Affordable Options: Access plans with low premiums, deductibles, or co-pays.

- Network Access: Choose from a wide selection of in-network doctors and specialists.

- Preventive Care Focus: Many plans cover annual checkups and wellness visits.

- Ongoing Support: We’re here even after you enroll to answer questions and manage changes.

Take the Next Step

Your health matters. We’d like to help you protect it. Request a free consultation today or call now to speak with a licensed advisor.

Frequently Asked Questions:

What types of health plans do you offer?

We provide PPOs, HMOs, and high-deductible options with HSA eligibility.

Is a subsidy available?

Yes, we help determine if you qualify for premium tax credits.

Can I keep my doctor?

We work to find plans that include your preferred providers.

What’s the difference between PPO and HMO?

PPOs offer flexibility; HMOs are usually more affordable but require referrals.

What if I have a pre-existing condition?

Plans cover pre-existing conditions under current law.